IRS Tax Brackets 2020-2021

Summary

If your itemized deductions are greater than the allowed standard deductions, it may be worth itemizing those deductions. Otherwise, everyone qualifies for the standard deduction. See the table below for standard deductions. Single Filier $12,400 Married Filing Jointly $24,800 Married […]

If your itemized deductions are greater than the allowed standard deductions, it may be worth itemizing those deductions. Otherwise, everyone qualifies for the standard deduction. See the table below for standard deductions.

| Single Filier | $12,400 |

| Married Filing Jointly | $24,800 |

| Married Filing Separately | $12,400 |

| Heads of Households | $18,650 |

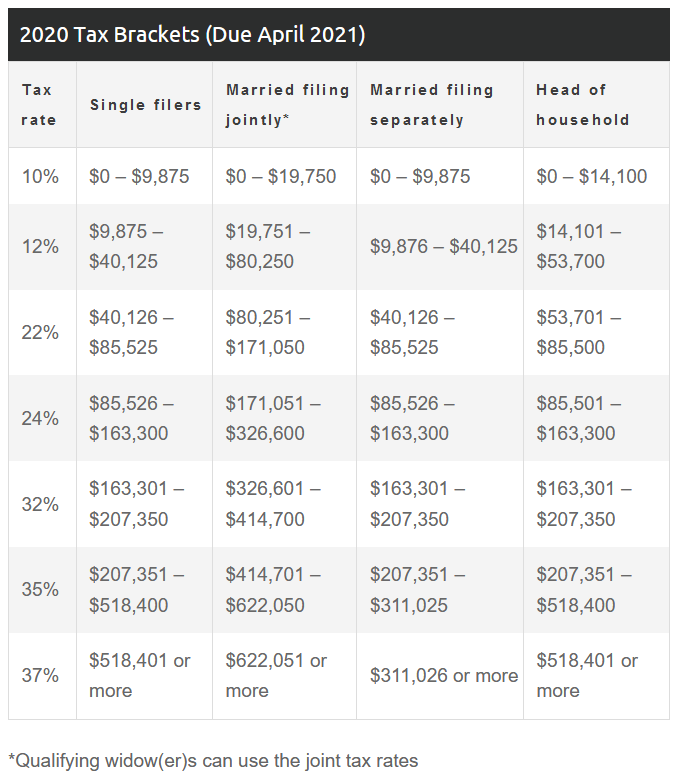

The United States uses marginal tax rates. This means you can have different tax rates as your income increases. For example, you may pay 10% on the first $9,875, then pay 12% on any earnings from $9,876 – $40,125, etc. You could fall into several tax brackets based on income.